Fuel and charging expenses – a quick guide for fleets

Fuel expenses are inevitable for fleet managers, but they’ve become more complicated as electricity accounts for a larger share of claims. This guide outlines the different methods for reimbursing drivers, and the pros and cons of each approach.

How can drivers claim back the cost of petrol or diesel?

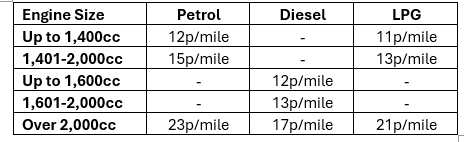

For company cars and vans, business-use fuel is reimbursed using a set of per-mile rates depending on the vehicle’s engine size.

HMRC’s Advisory Fuel Rates (AFRs) are adjusted quarterly to reflect pump prices and the average efficiency of fleet-operated vehicles, and they also apply to hybrids (including plug-ins) [1]. From 1 March 2025, the rates are as follows:

What drivers claim for charging electric vehicles?

Almost a third (29%) of company cars are electric, according to the latest HMRC statistics [2], and they use a similar mileage-based reimbursement system.

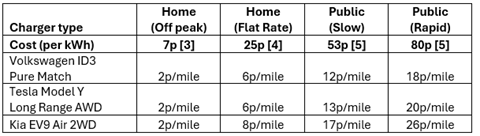

The Advisory Electric Rate (AER) is adjusted quarterly and is currently 7p per mile. This simplicity has also faced criticism for not reflecting differences in vehicle efficiency or charging costs, as illustrated by the following examples.

The AER can leave drivers out of pocket if they are using public chargers and overcompensate them for the cost of home energy. However, most would use a combination of both. Charged using an off-peak tariff, a Tesla Model Y would average 7p per-mile even if 30% of its annual business miles were using energy from rapid chargers.

What are the mileage rates if drivers use their own cars?

HMRC publishes a flat 45p-per-mile rate for drivers using their own vehicles (often called the ‘grey fleet’) for business trips. This applies regardless of fuel type or CO2 emissions and covers wider running costs, including finance, insurance and wear and tear, as well as the fuel [6].

The exception is drivers covering more than 10,000 business miles within a year. Above that threshold, the rate drops to 25p per mile.

When might fleets want to set their own rates?

HMRC’s advisory rates are designed to for simplicity but don’t always reflect true operating costs. For example, fleets using very efficient vehicles, drivers relying on expensive public charging, or when quarterly adjustments haven’t kept pace with rising fuel or energy prices.

However, they are not legally binding. Fleets can either set their own per-mile rates or reimburse drivers for the actual cost of fuel or electricity, but they would need to prove that drivers aren’t being over-compensated. Any excess could be classed as additional taxable income.

What if employers cover the cost of fuel for private journeys?

There are similar reimbursement options for employers if they cover all of a driver’s fuel costs – for example, using a fuel card – but accurate records are vital if the vehicle is available for business and private use.

Drivers can repay employers for private mileage using HMRC’s advisory rates, the actual cost of fuel used, or pay tax on the fuel as a Benefit-in-Kind. The cash equivalent of that benefit is calculated differently, depending on the vehicle.

Car Fuel Benefit Charge

Cars use a flat value (currently £28,200 [7]) multiplied by the company car tax band [8]. For example, a vehicle emitting 116g/km CO2 falls into the 29% band, so the value of the benefit is 29% of £28,200 – or £8,178.

Van Fuel Benefit Charge

Vans have a set value of £769, regardless of CO2 emissions. The only exception is double-cab pickup trucks, which are treated as cars for Benefit-in-Kind purposes [9]. That includes fuel benefit charges.

Electric Vehicle exemption from Fuel Benefit Charge

Electric vehicles are exempt from fuel benefit charges, because HMRC doesn’t treat electricity as a fuel. This includes public and workplace charging, the latter also covering staff carpooling with a non-employee [10, 11].

Drivers pay a percentage of the taxable value each year based on their income tax bracket (typically 20% or 40% in England and Wales), while employer NICs are charged at 15%.

Practical tax guidance for fleets

Ayvens’ 2025 Fleet Funding and Taxation Guide offers detailed, user-friendly analysis and insights about the UK’s fast-changing financial landscape. Compiled by our Consultancy Services team with experts at Deloitte, it’s a comprehensive analysis of the different options available for cars and vans, with rich insights into the resulting tax and cost implications, including:

- Funding options such as lease or outright purchase, and the tax relief available.

- Company car tax and the incoming changes for plug-in hybrids and pickups.

- Salary sacrifice schemes and how these can benefit employers and employees.

- Vehicle Excise Duty and how the ‘Expensive Car Supplement’ affects EVs.

- Grants and incentives for low-CO2 cars and vans.

To download your copy of this essential desktop guide

REFERENCES:

[1] https://www.gov.uk/guidance/advisory-fuel-rates

[2] https://www.gov.uk/government/statistics/benefits-in-kind-statistics-june-2024/benefit-in-kind-statistics-commentary-june-2024

[3] https://octopus.energy/ev-tariffs/

[4] https://www.ofgem.gov.uk/energy-price-cap

[5] https://www.zap-map.com/ev-stats/charging-price-index

[6] https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim31240

[7] https://www.gov.uk/government/publications/income-tax-van-benefit-charge-and-fuel-benefit-charges-for-cars-and-vans-from-6-april-2025/increase-to-van-benefit-charge-and-fuel-benefit-charges-for-cars-and-vans

[8] https://assets.publishing.service.gov.uk/media/5a7ee645ed915d74e62272b1/hs203.pdf

[9] https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim23151

[10] https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim23900

[11] https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim23900