Understanding Company Car Tax

How does the UK’s company car tax system work – and what could you save by going electric?

Fleets account for more than half of new cars sold in the UK [1], and that market is heavily influenced by tax. Since 2002, HMRC has used company car tax to encourage drivers into the lowest-CO2 options – stimulating demand for diesel plug-in hybrid (PHEV) and – most recently – electric vehicles (EVs). Here’s how.

What is company car tax?

HMRC treats any perks provided on top of an employee’s salary – such as health insurance, mobile phones or gym membership – as a taxable ‘Benefit in Kind’. That list includes company cars, if they are available for private journeys such as school runs, shopping or holidays.

Each workplace benefit has what’s called a ‘taxable value’ and, for cars, that’s a percentage of the list price (or P11d), which includes accessories, VAT, delivery charges and first-year vehicle excise duty, but not registration fees or any discounts applied. There are 28 bands, from 3% to 37%, weighted based on CO2 emissions and (for PHEVs between 1-50g/km) their electric range. The higher the car’s emissions and/or list price, the more tax is due.

The Autumn Budget confirmed tax bands through to 2030 [2], with some important details for fleets:

- Electric vehicles (0g/km) will increase by 1% point each year, from 3% in 2025/26 to 5% in 2027/28, then 2% points in the following two tax years – to 7% and then 9% in 2029/30.

- PHEVs between 1-50g/km will no longer be incentivised based on their electric range from April 2028. They’ll move into a single 18% company car tax band, rising to 19% the year afterwards.

- The top 37% band (>154g/km) will increase by 1% point each year from 2028/29 onwards. However, the latest HMRC statistics suggest only 3% of company car drivers have vehicles with emissions that high.

What are the company car tax rates?

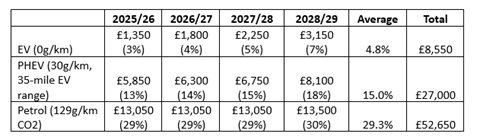

Although rates for EVs and PHEVs rise more steeply than for other vehicles, they will continue to be incentivised for the duration of a four-year contract. The following table shows three worked examples, calculating the total taxable value for three vehicles with a P11d value of £45,000.

How much company car tax do employees pay?

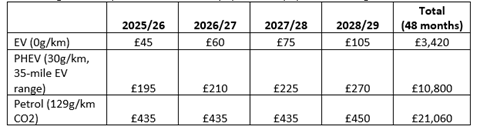

Employees pay Benefit-in-Kind for private use of the company car, at the same rate as their income tax band. That’s typically 20% or 40% in England and Wales (Scotland has its own bands) and would be collected as part of their wages.

Continuing the examples above, a 40% taxpayer would pay the following each month:

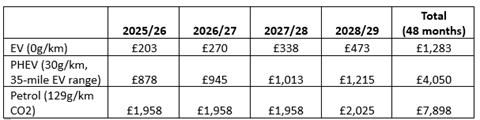

How much company car tax do employers pay?

Employers pay Class 1A National Insurance Contributions (NICs) for providing the benefit of a company car. NICs are a flat 15% of the taxable value, which means the level of incentive is the same as it is for drivers – as illustrated below.

Are there any exceptions?

Yes, if vehicles are provided under a salary sacrifice scheme then this is classed as an optional remuneration arrangement (OpRA). That’s a term for a system where drivers can give up some of their gross income to pay for workplace benefits.

Since 2017, HMRC has valued those benefits based on the amount of salary used to fund them – for cars, that’s the cost of the monthly lease. However, there is an exemption for vehicles with CO2 emissions under 76g/km, where the taxable value is still based on the company car bands. This usually offers much lower driver Benefit-in-Kind and employer NICs than for other vehicles.

EV incentives have fuelled renewed demand for company car schemes, with an additional 40,000 drivers paying Benefit-in-Kind during 2022/23 compared to the previous year. Almost half (47%) are in vehicles with 50g/km or lower CO2 emissions, while 29% were in EVs [3].

Is there a tax on company vans?

It depends how they’re used. Light commercial vehicles (LCVs) are classed a Benefit-in-Kind if drivers can use them for personal journeys. Their taxable value is charged at a flat rate (called the Van Benefit Charge) which is currently £4,020, regardless of CO2 emissions [4]. That equates to around £67.50 per month for driver in the 20% income tax bracket.

However, the treatment of double-cab pickup trucks – which have two rows of seats, four doors and an uncovered area behind the cab - changed on 6 April 2025. Vehicles registered from that date are taxed as cars, based on CO2 emissions instead of the Van Benefit Charge [5]. Most diesel pickups fall into the highest 37% tax band, so those changes result in a five-times higher tax bill for fleets and drivers.

There are some alternatives coming to market. The Ford Ranger Wildtrack PHEV would deliver 40% lower tax bills compared to the diesel version, though that’s still more than twice what the plug-in would have cost to tax under the old system.

Where can I find out more about fleet tax?

Ayvens’ 2025 Fleet Funding and Taxation Guide offers detailed, user-friendly analysis and insights about the UK’s fast-changing financial landscape. Compiled by our Consultancy Services team with experts at Deloitte, it’s a comprehensive analysis of the different options available for cars and vans, with rich insights into the resulting tax and cost implications, including:

- Funding options such as lease or outright purchase, and the tax relief available.

- Company car tax and the incoming changes for plug-in hybrids and pickups.

- Salary sacrifice schemes and how these can benefit employers and employees.

- Vehicle Excise Duty and how the ‘Expensive Car Supplement’ affects EVs.

- Grants and incentives for low-CO2 cars and vans.

To download your copy of this essential desktop guide

REFERENCES:

[1] https://www.smmt.co.uk/march-2025-new-car-pre-registration-figures/

[2] https://www.gov.uk/government/publications/autumn-budget-2024-overview-of-tax-legislation-and-rates-ootlar/annex-a-rates-and-allowances

[3] https://www.gov.uk/government/statistics/benefits-in-kind-statistics-june-2024/benefit-in-kind-statistics-commentary-june-2024

[4] https://www.gov.uk/government/publications/optional-remuneration-arrangements/optional-remuneration-arrangements

[5] https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim23151