Navigating tax cliff edges: How salary sacrifice supports smarter mobility choices

Discover how salary sacrifice schemes can help you manage tax thresholds and access flexible mobility solutions with Ayvens. Practical insights for smarter financial and mobility planning.

Guest blog from Phil Jones, Specialist Consultant at Ayvens UK

As the 2025 Autumn budget approaches, many of us are thinking about how tax changes might affect take-home pay.

Media speculation has been rife, although most seem to agree that tax rises in some shape or form are necessary to ensure the government sticks to its own financial rules. The Labour Government pledged in its election winning manifesto that it would not raise income tax, National Insurance or VAT. However, things do change, and it’s hard to see how the government can take the tax revenue needed without touching one of these three big levers. Clearly, we have no view on whether this is in their thinking, however it did make me want to look in a little more detail that the complexities of the UK tax system for workers.

Depending on whose view you read, we’re taxed too much, or we’re taxed too little, or maybe, like Goldilocks, it’s just right. These three things cannot all be true which leads me to believe that the key differentiator in people's beliefs is simply perspective. And it's quite easy for me to see how these different perspectives can be reached.

At Ayvens, we understand that navigating the UK tax system can feel complicated – especially when factors like National Insurance contributions and personal allowances come into play. We want to help you see clearly how salary sacrifice schemes can offer practical benefits as part of your overall financial and mobility planning.

Understanding marginal and effective tax rates

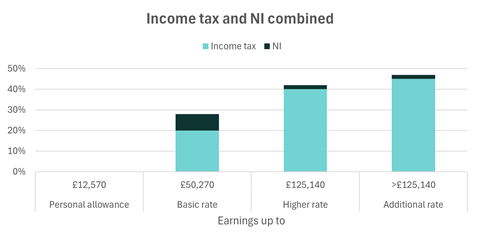

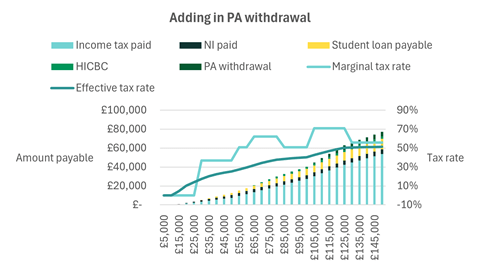

On the face of it, our tax system looks relatively simple, and I'll stick to using the tax rates for England, Wales, and Northern Ireland for now. You probably know about the headline income tax bands of 20%, 40%, and 45%. The higher rates of tax are paid on higher incomes, which most would see as a progressive tax system. However, our tax system is much more nuanced than this the more you dive into it. When you add National Insurance contributions – 8% for basic rate taxpayers and 2% for higher rate taxpayers – your actual marginal tax rates effectively rise to 28%, 42%, and 47%.

Moreover, the £12,570 personal allowance means you don’t pay income tax on earnings below this level, which affects your overall effective tax rate – the average rate of tax you pay across your total income.

What are tax ‘cliff edges’?

Certain income thresholds can trigger reductions in benefits or allowances, creating ‘cliff edges’ where your net earnings per pound can change abruptly. There are three scenarios I’d like to focus on:

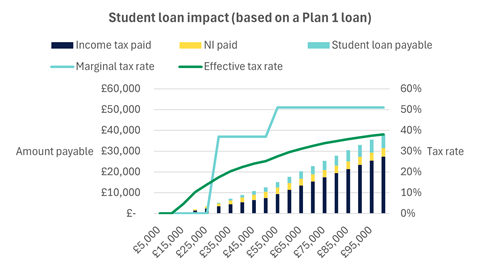

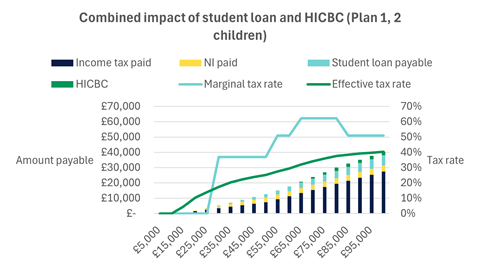

- Student loan repayments: start once earnings exceed a set amount, taken directly from your gross pay. This is not a tax but will feel like a tax; it will be an erosion of the value of each pound someone has been paid as salary. And its effect on someone's marginal, and effective, tax rate is quite noticeable.

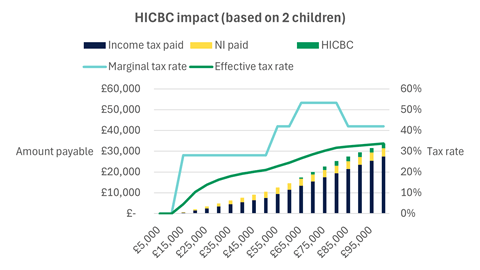

- High-Income Child Benefit Charge: reduces child benefit eligibility if you (or your partner, if you live with one) earn more than £60,000 a year. For every £200 you receive above £60,000, you need to pay back 1% of the maximum amount of Child Benefit you're entitled to. Once you hit £80,000 a year, the charge you'll pay back is equal to 100% of your entitlement.

- The £100,000 Personal Allowance withdrawal: above this salary, your tax-free allowance gradually reduces, increasing your tax rate on some earnings. For every £2 earned over £100,000, workers lose £1 of their personal allowance. As the personal allowance is withdrawn, each £1 that is taken away is subject to 40% income tax. It is therefore true to say that once you go over £100,000 a year you are effectively being taxed at 60% up to £125,140.

For many workers, these combined effects make understanding take-home pay more complex than just looking at basic tax rates.

How salary sacrifice offers practical support

Salary sacrifice schemes enable you to exchange part of your salary for non-cash benefits – such as an electric vehicle – by adjusting your taxable income. This can help manage how close you come to these tax thresholds, potentially easing the impact of cliff edges on your finances.

Salary sacrifice is a structured, transparent way to integrate benefits into your compensation package – helping you plan better, access a range of mobility options, and manage your financial wellbeing.

Supporting smarter, more flexible mobility

At Ayvens, we provide mobility solutions designed to fit diverse needs and budgets. Our salary sacrifice options make it easier for employees across different income levels to benefit from the convenience and innovation of electric vehicles as part of a broader sustainable mobility journey.

If you’re considering how to optimise your income and mobility choices, Ayvens is here to help with expert advice and tailored schemes.

For more information on how salary sacrifice works and how it could fit your situation, get in touch. Together, we’ll find the right way forward.

Ayvens. Better with every move.