Consultancy Insights – EV Salary Sacrifice Phil Jones

Our Ayvens perspectives series covers insights from the Ayvens consultancy team on tackling the latest mobility trends and solving complex fleet challenges.

Guest blog by Phil Jones , Specialist Consultant, Ayvens in the UK

“When was the last time you saw an advert for a car that wasn’t electric? I asked myself this question the other day and genuinely couldn't think of the answer. If we were to believe the advertising, everybody is buying electric vehicles, and you can’t buy a petrol or diesel car anymore – but is that really the case? It depends which part of the market you’re looking at.”

EV Sales compared to petrol or diesel

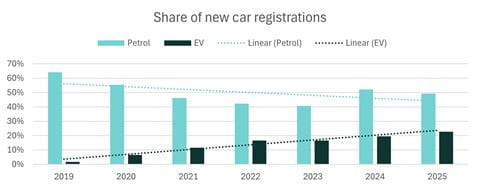

Battery electric car sales have surged over the last five years, with SMMT data showing almost 382,000 were registered in 2024 – ten times more than in 2019 [AA, AB]. That momentum has continued into Q1 2025, with BEVs accounting for more than one in five (20.7%) new cars.

However, although it’s declining in popularity, petrol remains the most popular powertrain with a 49% share of the market in the first three months of the year.

There are two key factors to look at; supply and demand. Manufacturers on the supply side are clearly pushing electric vehicles above all else. One of the key reasons for this is laid out in a piece of legislation called the Zero Emission Vehicle (ZEV) mandate.

This statutory instrument, which came into force in January 2024, requires 80% of new cars and 70% of vans to be zero-emission at the tailpipe (electric or hydrogen fuel cell) by 2030, rising to 100% in both cases from 2035. From 2030, the remaining 20% of new cars that aren’t ZEVs must include at least hybrid technology to be sold in the UK.

In the meantime, the mandate requires an increasing percentage of new car and van sales to be zero-emission each year, with stiff financial penalties for manufacturers who fail to meet those targets. It’s pushed them to prioritise advertising (and discounting) electric vehicles to avoid those fines.

Why do we need the ZEV mandate?

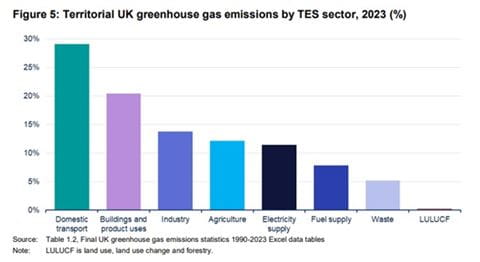

You may ask, why does this legislation exist? Well, the Department for Energy Security & Net Zero states that in 2023 (the latest available data) the biggest source of UK carbon emissions (29% of the total) came from domestic transport [ac]. Of that, 89% came from road transport – which means more than a quarter our country's CO2 emissions are a result of the vehicles we drive. Reducing those emissions is vital if the UK is to achieve its 2050 target of becoming a net zero carbon economy.

What’s influencing customer demand for EVs?

The choice of EVs is increasing all the time – rising 38% year-on-year to 132 models in 2024, according to the SMMT [ag], while BloombergNEF is reporting an 84% drop in battery prices over the last decade, which is enabling more affordable, longer range vehicles. Most new models can travel more than 200 miles to a full charge, and some have reached price parity with their petrol counterparts.

Meanwhile, sustainability has become an important selling point for consumers. A recent survey by Deloitte found half (51%) are trying to reduce their energy consumption, while 41% are anxious about climate change and 36% consider the environmental impact of products before buying them [af].

Those trends are supported by incentives, though most are focused on company car drivers who enjoy low benefit-in-kind (BiK) tax. Benefit-in-Kind is based on the list price, CO2 emissions and (for plug-in hybrids) the electric range of the vehicle they take. Zero-emission vehicles attract the lowest rates, offering car-entitled employees financial motivation to switch to EV.

However, this has created an imbalanced market, with DfT data showing only 16% of new EVs being sold to individuals and the rest registered to companies [ah]. It reflects a consumer market that isn’t getting the same financial benefits for going electric as corporate drivers – especially when household budgets are squeezed.

Statistics compiled by the BVRLA (compiled from its members data) scratch further away at this. In the last year Business Contract Hire (BCH) agreements are up 6%, Personal Contract Hire (PCH) agreements are down 13.4%, while salary sacrifice is booming, growing 61% in the last year [ae].

Sacrifice a little, save a lot

Salary sacrifice is a mechanism whereby employees can give up some of their salary in exchange for a benefit – which, in this context, is a car.

Businesses running these schemes effectively make company cars available to a much wider pool of employees, by leasing those vehicles from a provider (such as Ayvens) and enabling employees to pay for the monthly rentals using their pre-tax salary. The main caveat is their remaining salary can’t be lower than the minimum wage threshold.

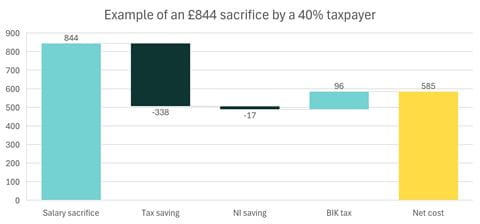

This system heavily favours plug-in vehicles. As long as the vehicle’s CO2 emissions are no more than 75g/km, which encompasses most PHEVs and all EVs, the taxable value of that benefit is calculated using low company car tax bands instead of the cost of the monthly rentals.

The result? Nine out of ten salary sacrifice drivers are choosing an EV, according to the BVRLA [ae], and I believe we’re seeing a substitution effect as drivers with access to a salary sacrifice scheme use that route to get a new car instead of retail channels. BVRLA members’ combined PCH fleet has fallen by 61,000 cars between Q4 2021 and Q4 2024, the number of salary sacrifice vehicles increased by 68,000 during the same period [ai, ae].

It’s easy to see why. Electric vehicles are still more expensive than combustion engine equivalents in retail leasing. With the tax efficiency salary sacrifice schemes offer, they’re one of the most affordable ways for drivers to get into a new electric car.

Our own data almost perfectly mirrors that of the BVRLA. Ayvens’ Salary Sacrifice fleet grew 58% in 2024 and is comprised almost entirely of electric vehicles. And I don’t think we’ve reached peak salary sacrifice as an industry yet.

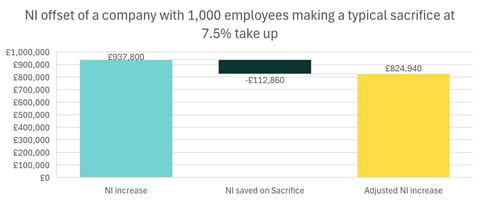

In the Chancellor’s Autumn Statement 2024, employers’ NICs were hit twice – with a lower income threshold at which businesses start paying and a higher rate at which they’re paid. For the average UK employee (based on a median salary of £36,000, according to the ONS [aj]) this means an increase of £938 per employee per year. Coupled with a rise in the national minimum wage threshold, employers are under pressure.

Salary sacrifice schemes don’t eliminate these costs entirely – but they certainly help. On average, our customers saved £661 in Class 1 NICs for every salary sacrifice car they put on the road, which would offset 70% of the NIC increase for the average employee.

However, sacrifice amounts and the amount of the employers’ NIC that is retained vary between customers. Some were seeing savings of over £1,250 per car – enough to offset the increase of 1.33 employees. With rate rises starting to be felt by businesses, salary sacrifice presents an opportunity to help offset some of that impact.

Those conditions aren’t set to change any time soon. Battery prices are continuing to fall, the choice of vehicles is improving, and low company car tax bands are in place until at least 2030. With ongoing pressure on household and business budgets, and sustainability high on the agenda, salary sacrifice schemes are mutually beneficial for employers and employees alike.

“So, have we reached peak salary sacrifice? I highly doubt it. In fact, I think we’ll see another year of explosive growth in 2025.”

Find out more

If you’re thinking about a salary sacrifice scheme for your employees, or maybe already have one in place and want to discuss how to measure and maximise its potential, I will be attending Company Car in Action on 11-12 June and would love to discuss it with you there.

Fleet Consultancy Services | Ayvens United Kingdom - formerly LeasePlan

REFERENCES:

[aa] https://www.smmt.co.uk/record-ev-market-share-but-weak-private-demand-frustrates-ambition/

[ab] https://www.motorfinanceonline.com/news/smmt-new-car-registrations-2019/

[ad] https://www.bvrla.co.uk/asset/5CB62B4C%2D44E0%2D4714%2DA428E461E983DCC8/

[ag] https://www.smmt.co.uk/record-ev-market-share-but-weak-private-demand-frustrates-ambition/

[ah] VEH1153: Vehiclesregistered for the first time by body type, fuel type and keepership (privateand company): Great Britain and United Kingdom (ODS, 11.3 MB)

[ae] https://www.bvrla.co.uk/static/5cb62b4c-44e0-4714-a428e461e983dcc8/BVRLA-LOR-APR25-Final.pdf

[ai] https://www.bvrla.co.uk/asset/BA272F33%2D8AA9%2D4CA3%2D833DB7465CC858CF/