Taxation

Benefits in kind

A number of changes affect the calculation of the benefit in kind on company cars.

The benefit in kind no longer depends solely on the investment value of the vehicle, but also on its CO² emission rate and engine type.

In short, the date on which you sign your contract determines the tax regime to which you are subject. On this page, you will find details of the different regimes and their conditions.

Electric vehicle bonus

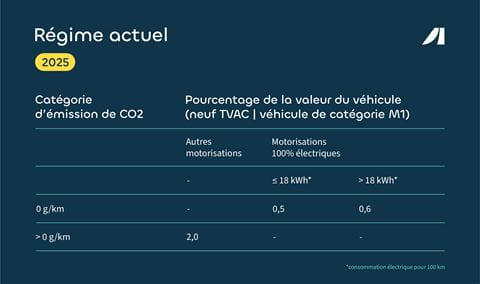

Current tax system (2025)

Since January 2025, the rule has been simplified into two categories and three tax rates for calculating the ATN for 100% electric vehicles with zero emissions and other types of engines.

This regime applies to all vehicles ordered from 1 January 2025. The previous regime will remain in place for all vehicles ordered before that date and registered in 2025.

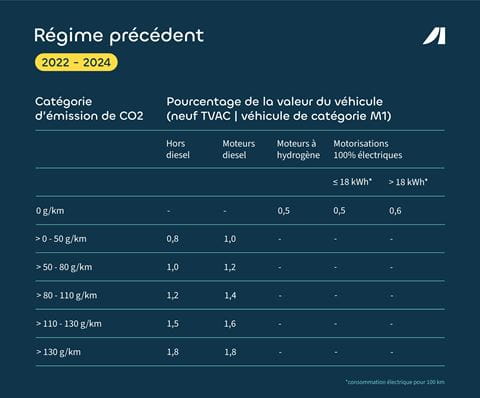

Previous tax system (2022-2024)

The previous tax regime for calculating ATN was as follows. This regime will continue to apply to:

- Vehicles registered from 1 January 2022 onwards.

- Vehicles for which a contract has been signed between 1 January 2022 and 31 December 2024, as well as vehicles registered during this same period.

Please note that proof of the signed contract will be the customer's order to the leasing company (e.g. signed offer) stating the order date, the description of the car, and the lessee's and driver's details.

Tax system 2017-2021

The tax regime applicable for calculating the ATN for the period 2017-2021 was as follows. This regime applied to:

- Vehicles registered before 31/12/2021.

- Vehicles for which a contract was signed before 1 January 2022 and vehicles registered before 1 January 2023.

Please note that proof of the signed contract will be the customer's order to the leasing company (e.g. signed offer) stating the order date, the description of the car, and the lessee and driver information.